This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Read More

COMPANY

PRODUCTS

CORPORATE GOVERNANCE

RESOURCES

GEMBlock

CREATING A NEW ASSET CLASS: GEMSTONES

Individual gemstones are converted into individual NFTs. By Digitally Melting™, those NFTs are turned into a tradable digital unit. The result: A standardized, by blockchain secured, tradable, and fungible commodity.

About Us

The Mission

Utilizing blockchain technology to enhance accessibility and establish gemstones as a novel asset class like stocks, gold, and real estate for investors, HNWI, family offices, and banks to further diversify their portfolio.

Leveraging blockchain technology, GEMBlock will simplify, secure, and scale up gemstone investments.

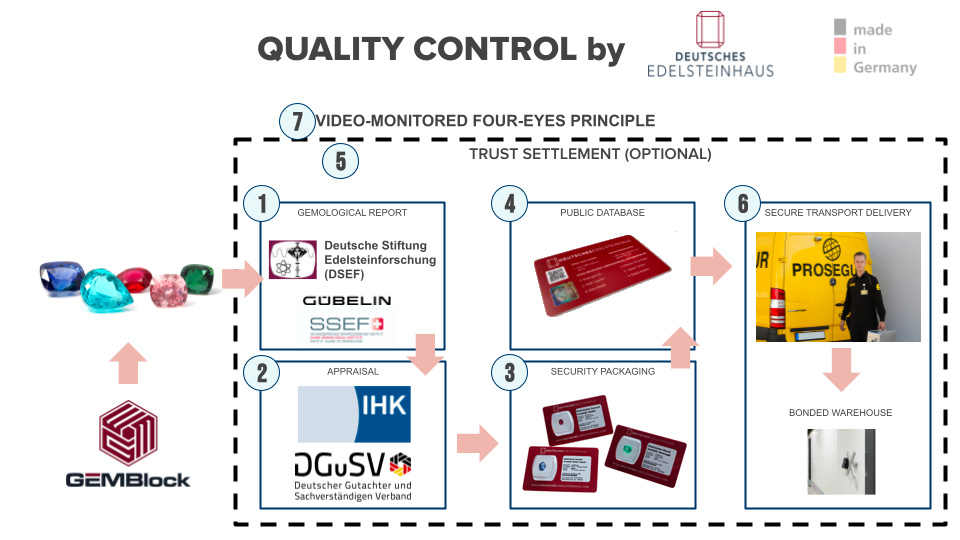

GEMBlock's ecosystem resolves the once complex process of authentication, evaluation, transport, storage, and resale of gemstones.

This makes them easy investible - for everyone.

The Vision

Our vision is to make gemstones available as a new prudent asset class by using blockchain technology.

Leveraging blockchain technology, GEMBlock will simplify, secure, and scale up gemstone investments.

GEMBlock's ecosystem resolves the once complex process of authentication, evaluation, transport, storage, and resale of gemstones and makes them easy investible for the first time in history.

Why Gemstones?

For over 5000 years, gemstones have served as a robust store and sign of wealth and might.

Unmanipulated

The market of colored gemstones (like ruby, sapphire, or emeralds) has never been manipulated or controlled by an oligopoly (like gold or diamonds)

Rare

The yearly value of newly mined gemstones is estimated to $35B and therefore rare. It is big enough to stand as an asset class of its own, but too small and complicated for governments to control – unlike gold.

Unrestricted

Throughout history, there has never been a ban or confiscation on gemstones (unlike silver or gold).

Unique

Gemstones grow over millions of years and are “natural”. So every single gemstone is unique – like your fingerprint.

Conserving

Gemstones have historically proven effective in conserving buying power due to their enduring value and resilience against market fluctuations.

Low Volatility

Gemstones prioritizes safety over large profits, offering an investment option with minimal volatility. Its focus is on providing a secure and stable asset class rather than chasing high returns.

Unlinked

Gemstones' value, being unlinked from traditional financial markets, offers a diversification hedge in investment portfolios, unaffected by stock market fluctuations or interest rates.

Endurance

High-quality, rare gemstones typically appreciate significantly over time, offering steady long-term value growth due to their rarity and enduring demand.

A Stable Investment

From a traditional perspective, gemstones are often seen as a "stable investment" – they don't have the rapid, high-risk growth potential of cryptocurrencies, but offer steadier, more predictable development.

The Problem of "Stable"-Coins

A "traditional" stablecoin is pegged to a fiat currency like the US dollar and thus offers stability – a mirage considering the money supply.

Increasing money supply results in increasing inflation and loss of purchasing power.

Inflation is expropriation.

Being stable to an “asset” that is loosing its value over time is

not a means for preserving wealth, nor a viable basis for wealth creation.

Dollar Pegging

Pegging to the US-Dollar subjects stable coins to the economic and monetary policies of the United States with all its risks (increase of money supply).

Inflation

Inflation erodes the purchasing power of a stablecoin pegged to a fiat currency, undermining its stability and consistency in value.

Control

Centralized control undermines the decentralized ethos of cryptocurrencies, making stable coins susceptible to regulatory interventions and potential manipulation.

Investor's Credo In 2024:

"Today it’s not about return ON investment.

It’s about return OF investment."

Introducing GEM Token

GEM is an ERC-20 token created by GEMBlock that represents fractional ownership of physical investment-grade colored gemstones held in secure storage facilities. The fungible token aims to combine the enduring intrinsic value of gemstones with the accessibility and tradability of crypto assets.

By bringing real-world assets on-chain, GEM provides a transparent and democratized way to invest in the traditionally opaque and illiquid gemstone market.

The protocol incentivizes keeping GEM's value pegged to the underlying gemstones through a minting/burning mechanism and on-chain arbitrage.

The Usecases Of The GEMBlock Ecosystem

GEM is more than just a cryptocurrency; it represents a liquid, tradable share of the entire gemNFT collection, with GEMTrust DAO enhancing its value and expanding its use cases, some of which are outlined below.

Here are some potential usecases of 2nd level GEM token applications:

Treasury

Protecting wealth for institutions like DAOs and exchanges can consolidate trust.

Collateralization

Given the growing significance of DeFi and the need for stable collateral, GEM's potential here is paramount.

Wealth Preservation

Financial growth and safeguarding wealth is a core requirement for most investors.

Diversification

An asset class that offers diversification is essential in any robust portfolio.

Escrow Services

As more transactions move online, secure escrow services gain prominence.

Asset Backing

The intrinsic value provided by gemstones offers credibility and a solid foundation to the token's valuation.

Estate Planning

Ensuring wealth transfer for future generations is fundamental for long-term financial planning.

Risk Management

Bridging the divide between traditional finance and digital assets, promoting broader acceptance and trust in the cryptocurrency realm.

Future Applications

The future holds applications beyond our current imagination, set to revolutionize industries we've yet to conceive.

More About The GEM Token

One Pager

Download our one-pager for a detailed insight into GEMBlock, tailored for institutional investors.

Whitepaper Short Form

Take a comprehensive view on GEMBlock by exploring the Short Form of the White Paper.

Meet The Team

Meet the dedicated team behind GEMBlock's vision and innovation.

Alexander Streeb

Founder

Alexander has been an active participant within the financial sector for over 30 years, as an investor, entrepreneur, and as the former CEO of GECAM AG, a German asset manager.

Gordan Kljajic

Founder

With over two decades as an entrepreneur, Gordan stands as an esteemed expert in high-value sales, boasting an impressive 15-year background in marketing and strategic consulting.

Dr. Fabian Schmitz

Gemology Advisor

A renowned researcher in gemology and rare earth elements, board member of the German Chamber of Industry and Commerce and curator of the German Gemstone Museum

Ian Scarrfe

Advisor

Key Opinion Leader and Top Global Influencer in Blockchain and Fintech, Independent Expert at the European Commission - Horizon 2020.

Dr. Li Geng (李 耿)

Quality Assurance

An associate professor at the University of Beijing and a member of the FGA (Fellow of the Gemmological Association of Great Britain) and DGA (Diamond Grading).

What We Are Looking For

We don't view ourselves as a traditional crypto project. Positioned at the intersection of the legacy financial system and the emerging digital economy, we've adopted a hybrid approach. To realize our vision, we are targeting three distinct types of investors.

Strategic Investors

Contribute beyond capital with industry expertise, expansive networks, and alignment with our mission, offering a blend of financial backing and insightful guidance and the willingness to implement the GEM token into their business.

Strategic Partners

Help us to get access to new markets, implement the GEMBlock ecosystem and foster collaborations that supercharge growth and foster innovation.

VC Investors

Drawing on their extensive experience and industry connections, these investors share our long term vision and bolster our market credibility and paving the way for new opportunities.

FAQ

1. How do we differ from other investment opportunities?

Working Business Model

We have developed a business model based on a successful enterprise in the real world, giving us a deep understanding of the actual problems and needs.

New Token Class

Thanks to the unique properties of gemstones, GEM is a hardcoin. It is not pegged to a fiat currency, but rather firmly anchored to the value of a basket of gemstones. Gemstones, along with gold, are the only financial elements that have historically demonstrated a consistent value preservation over millennia. This makes them a stabilizing factor in a portfolio, offering protection against inflation.

In positioning gemstones as a new asset class, we are also creating a new category of token with GEM: the hardcoin, independent of USD-based stablecoins.

Multi digit billion dollar potential

Given the financial background of GEMBlock's founders, a business model has been designed specifically for the financial market to meet its unique requirements. This positions it as a project with multi-billion dollar potential. Such projects are fundamentally rare.

2. How do we differ from other gemstone providers?

Vision

The main difference from other projects is that our vision is much larger. Gemstones are primarily known for their beauty and brilliance. Few people are aware that they have an additional intrinsic property: storing great values in the smallest of spaces and preserving them over generations. This property is extraordinarily interesting for the financial market.

We want to use not the gemstones themselves, but this intrinsic value for the financial market.

Gemstone Basket

The concept of the gemstone basket is unique. By grouping different types of gemstones in a single basket, we create additional security and stability against price fluctuations.

Proven Business Model

Furthermore, thanks to our partner DEH, we have a proven business model in terms of procurement, delivery, and valuation processes, right up to the proper and verified storage of the gemstones in a Swiss vault. In other words: We can prove that what we are doing works successfully and ultimately know how to sell the product.

We are tokenizing an existing business model and thus starting at the application end, so we are not putting the cart before the horse.

3. Why a Gemstone Basket

Stability

Our focus is on stability. Although gemstones themselves are already an investment with low volatility, we have balanced this risk by creating a basket.

Diversification

The basket of investment-grade gemstones balances – in line with the principle of diversification – price fluctuations in the gemstone market. This basket also allows us, thanks to DLT technology, to make something that is naturally non-fungible, fungible through blockchain technology, and thus accessible to the broader investment market as an asset class.

Interoperability

Through the concept of the gemstone basket, we can dominate the market, as we have the ability to acquire other gemstones (and entire gemstone projects) and implement them into our ecosystem. We thus become a facilitator and a "Layer-1" for all those who appreciate and want to utilize the properties of gemstones (stability, value retention, and independence from movements in the financial market).

4. Why are gemstones an interesting investment, especially for institutional investors?

Focus on Value Preservation

Institutional investors manage third-party money and thus have a high responsibility, especially regarding the preservation of funds. Therefore, conservative investments such as fixed-income securities, real estate, and government bonds are prominently represented in such portfolios. The problem is that these asset classes are only superficially safe. Economic crises, currency crises, and sovereign debt crises can turn a safe investment into a high-risk one.

Practically Risk-Free Asset

Land, gold, and gemstones, on the other hand, are generally considered safe because they are tangible assets, naturally limited, and not arbitrarily expandable. Of course, there are certain risks. Land can be conquered or expropriated, as can gold. This leaves gemstones as a scalable investment opportunity that offers stability, security, and protection from expropriation: they would thus be the ideal base investment in the portfolio of conservative investors, as they form a solid foundation on which more complex investment strategies can be built.

Interest is the price one pays for the risk of an investment.

What does it mean, therefore, that there are no interests on gold and gemstones?

The goal of an insurance company or a pension fund is NOT to make a profit. The goal is to NOT make a LOSS. It's about preserving values.

Centuries-Long Upward Trend

The value development of gemstones has a historical upward trend. There are many assets that have a (much) higher value development, but none that are still available centuries later. Stocks as an asset class have been around since the 17th century. The shares of the Dutch East India Company, the first joint-stock company, can no longer be traded on the market today. But the ruby they transported in the 17th century has not only retained its value to this day but has also increased it.

Therefore, gemstones are extraordinarily attractive for institutional investors with a high need for security and a long-term investment horizon.

Fun fact. Never in history has a renowned gemstone been sold at auction for a lower price than it was previously purchased.

5. What are the key advantages and solutions of GEMBlock?

Bridge Function

The era of the Wild West in the crypto world is nearing its end. The market is looking for realistic applications. We create a bridge between a practice-proven, existing business model in the real world and the DLT (Distributed Ledger Technology) world.

Digitization Resolves Complexity

The purchase and sale of precious stones is an enormously laborious and complicated process, which is simplified through our technology by digitizing the processes. This achievement was previously impossible: making something inherently non-fungible, fungible through blockchain technology, thus making it accessible to a wide range of interested parties.

Problem-Solving

GEMBlock thus offers several solutions to current problems in the gemstone trade:

- Safer purchasing

- Easier resale

- Professional evaluation

- Fungibility/Interchangeability, thus making it tradable on a marketplace where gemstones are uniformly tradable (like gold).

- Standardization of individually unique pieces

6. What is the total loss risk as an investor?

The total loss risk is practically zero.

We invest about 50% of the raised funds in precious stones, which are still available to the investor in the worst-case scenario.

Thus, investing in GEMBlock represents a venture capital with significantly limited risk.

7. What advantages do I have as an investor?

We offer a very investor-friendly setup.

Switzerland as a domicile offers legal security.

The IP of GEMBlock is held by an investment company, in which investors can participate up to 95%. Moreover, GEMBlock must acquire the gemstones through this investment company, whereby the trading margin remains in it and is used for the repayment of the investment funds. This ensures not only secured capital flows but also full control over the business operations of GEMBlock GmbH.

As an investor, you benefit overall from the position as a revolutionary who has helped to build a new market and has made the unmatched properties of gemstones accessible to the market.

The risk is minimal and the ROI is achieved within a few years. As a strategic partner, there is also the possibility of a long-term, mutually beneficial partnership.

Contact Us

office @ gemblock . cc

Telephone

Telephone: +60 (0) 13 - 3245841

Contact Form

Gemblock GmbH (in formation)

Switzerland

© Copyright GEMBlock - All Rights Reserved